south carolina inheritance tax 2021

The federal gift tax has an annual exemption of. Your federal taxable income is the starting point in determining.

State Taxes On Capital Gains Center On Budget And Policy Priorities

If you make 70000 a year living in the region of South Carolina USA you will be taxed 12409.

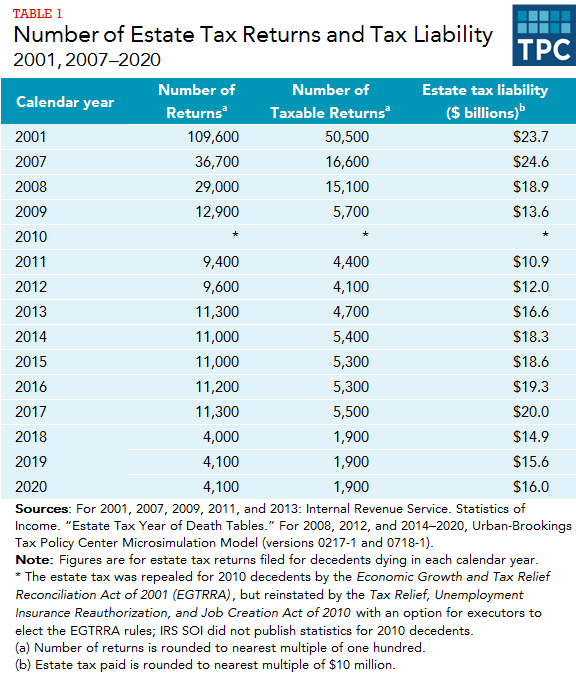

. In January 2013 Congress set the estate tax exemption at 5000000. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

South Carolina Estate Tax 2021. Your average tax rate is 1198 and your. South Carolina Estate Tax 2021.

Understanding South Carolina Inheritance Laws Beth Santilli Law. South carolina imposes a 542 tax on every gallon of liquor 108 on every gallon of wine and 77 cents on every gallon of beer. We invite you to come in and talk with one of.

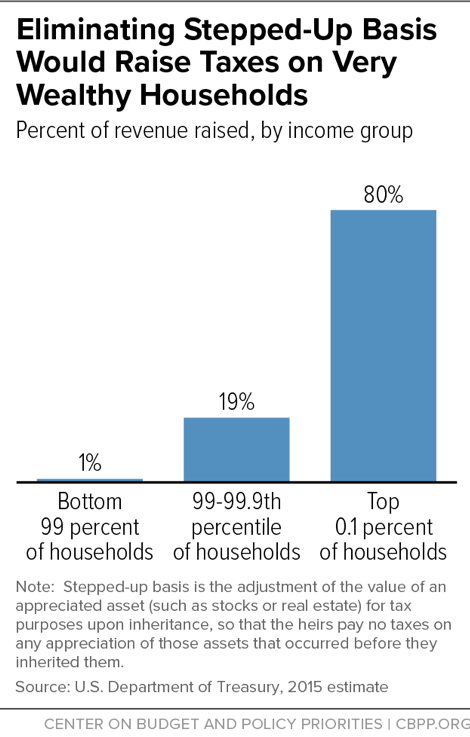

These gifts to beneficiaries are not subject to income tax but can be subject to capital gains tax. The top estate tax rate is 16 percent exemption threshold. South Carolina has no estate tax for decedents dying on or after January 1 2005.

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. As of 2021 33 states collected neither a state estate tax nor an inheritance. Ive got more good news for you.

A large number of returns 44 pay no income tax whereas 9 of returns pay 60 of the tax June. Connecticuts estate tax will have a flat rate of 12 percent by 2023. South Carolina Income Tax Calculator 2021.

South Carolina inheritance tax and gift tax. It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act. South Carolina Inheritance Tax Waiver.

As of 2021 33 states collected neither a state estate tax nor an inheritance. South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away. The top estate tax rate is 16 percent exemption threshold.

South Carolina does not assess an inheritance tax nor does it impose a gift tax. South carolina imposes a 542 tax on every gallon of liquor 108 on every gallon of wine and 77 cents on every gallon of beer. The SC1041 K-1 Beneficiarys Share of South Carolina Income Deductions Credits Etc is prepared by the estate or trust to show each beneficiarys share of the entitys income.

South Carolina is one of 38 states that does not levy an estate or inheritance tax. April 14 2021 by clickgiant. The federal estate tax has an exemption of.

The lawyers at King Law can help you plan for what happens after youre gone and were here to help you get a better sense of where you stand. In january 2013 congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation.

North Carolina Or South Carolina Which Is The Better Place To Live

What Is The Timeline Of An Audit In South Carolina

Lowcountry Food Bank Feed Advocate Empower

Understanding North Carolina Inheritance Law Probate Advance

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

South Carolina Estate Tax Everything You Need To Know Smartasset

Where S My Refund South Carolina H R Block

Act 176 And Third Party Collection Companies

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

South Carolina S 2021 Tax Free Weekend Kicks Off On Friday August 6

Clearing Up Confusion About Probate In South Carolina Gem Mcdowell Law 843 284 1021 Estate Business Law Local

Does South Carolina Require Inheritance Tax King Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Private Island Retreat In South Carolina Lists For 10 Million Mansion Global

Tax Credit Marketplace Closes 2021 Fund At 13 Million Soda City Biz Wire

Oklahoma City Retail Oklahoma Ranks No 3 For Economic Outlook Okcretail